Fundamentals

This course is designed to give you a better understanding on how to trade the financial markets. So in the first instance, we will explain the relationship between the financial markets and the real economy (the actions of governments, economic indicators and company results). Company results will only really impact equity markets and individual stocks rather than fixed income, currencies and commodities.

Role of government

Let us look at the government and their role. Governments want to achieve ‘sustainable growth’, which is basically growth without inflation. They go about this by controlling the level of activity in the economy and measure this activity in terms of the level of ‘nominal’ GNP (gross national product). The financial markets pay close attention to this too, as there is a well established relationship between this and ‘monetary aggregates’, which is basically the spending power in the economy.

A government will use interest rates to try and control growth and inflation. If there is low growth, they will try and reduce interest rates in an attempt to decrease the cost of credit and stimulate upward pressure on spending and economic activity. Some may argue this is inflationary, but as spending in the economy is low, they are just simply increasing it to normal levels. The opposite is true when there is high growth and interest rates are increased to any inflationary pressures.

The government may also use fiscal policy, where by they increase/decrease public spending and taxation. This is a way of adjusting individuals and households disposable incomes as well as the amount of money circulating in the economy.

Generally, when the economy is in a growth cycle, it is met with higher interest rates, higher taxes, and lower public spending. When we are in a recessionary cycle, there are lower interest rates, lower inflation, lower taxation, and higher public spending. This should help to avoid volatile economic cycles.

Economic indicators

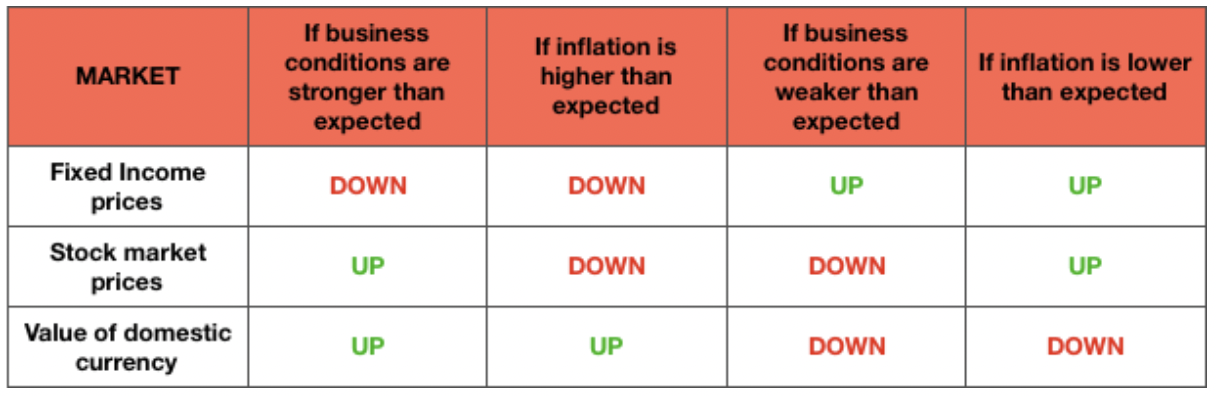

Now consider the impact of economic indicators. These indicators give us information about the state of the economy. This information ranges from employment, spending, growth etc. This helps financial markets to try to access the health of the economy. Generally the better the economy’s situation, the higher the stock markets will be supported by higher bond yields (lower bond prices) and stronger local currency.

Now, we will look into the various economic indicators in more detail and explain what they mean and their impact on each market.

GDP and GNP:

Gross Domestic Product measures the total value of a country’s output (total of all economic activity). The Gross National Product is the same as GDP but includes a country’s net earnings from abroad. So to put it simply, the GNP is a measure of monies generated by residents of the country in question, but is not limited to the domestic output as there is an element of it generated abroad.

Market reaction to unexpected changes in GDP/GNP:

An important point to note here is that GDP and GNP levels are predicted very easily by the market due to the components that make up the figures, hence any large variation from the unexpected figures will usually be the catalyst to move the markets.

Producer Prices Index:

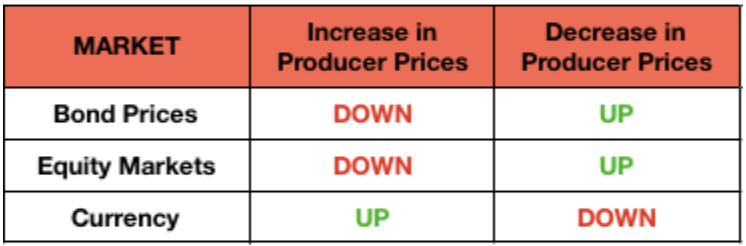

These are the prices that producers charge to the retail sector, hence a rise in these will lead to a rise in the overall retail prices charged to the consumers. It is obvious then that Producer Prices are a key indicator of inflationary pressure as there is such a direct link between retail prices and supplier prices. Analysts will keep a close eye on this figure as market sensitivity to any unexpected changes is very high.

Any inflationary pressure will lead to the monetary authorities to increase interest rates, and vice versa. The fixed income market sees large rises in inflation as cause for interest rates to rise, hence a large rise in inflation should see bond prices drop (yields to rise). Equity markets should see inflationary pressure as being negative as it decreases the amount of disposable income people have, as well as higher interest rates increasing the cost of credit.

Producer Prices Index are also impacted by commodity prices. Many commodities are supplies (e.g. Oil, agricultural raw materials, etc…) and any changes in the prices will directly impact the costs to the producers for their supplies which then follow through to the prices paid by retailers. Commodity prices are also seasonal so this must be taken into consideration.

Consumer Prices are the prices that are paid by the consumer on the street. This is obviously directly linked to the Producer Prices and the markets react in the same way as the table for Producer Prices.