Fibonacci Retracement

Fibonacci Numbers

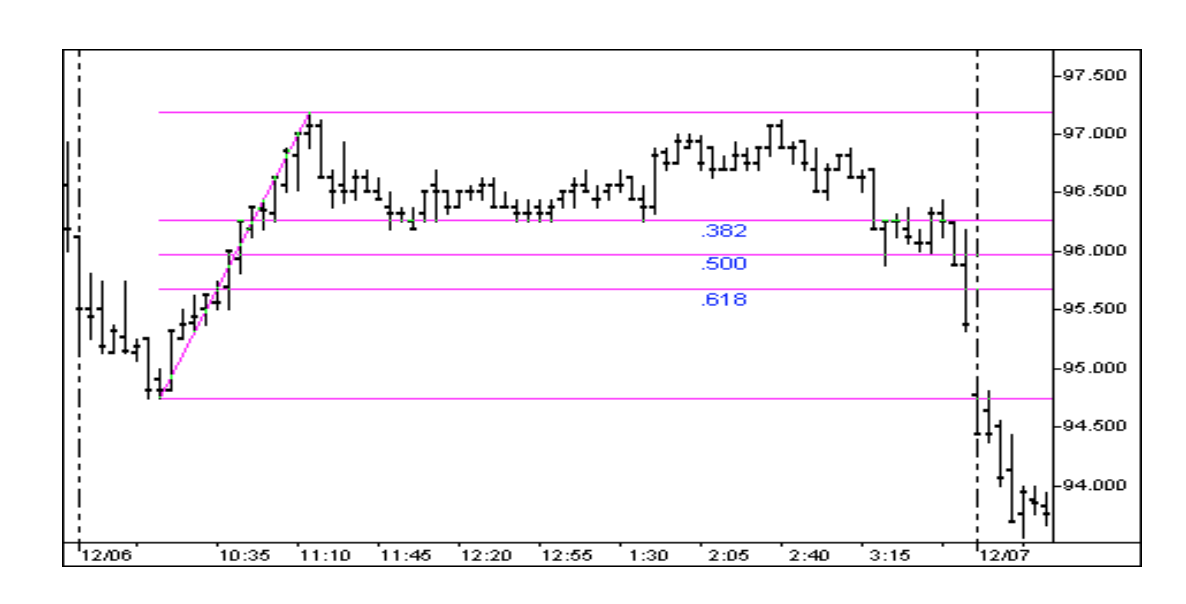

Fibonacci retracement is a very popular tool among technical traders and is based on the key numbers identified by mathematician Leonardo Fibonacci in the 13th century. In technical analysis, Fibonacci retracement is created by taking two extreme points (usually a major peak and trough) on a Chart.

The key Fibonacci ratios are…

23.6%, 38.2%, 50%, 61.8% and 100%

Fibonacci retracement is a very popular tool used by many technical traders to help identify strategic places for transactions to be placed, target prices or stop losses. The notion of retracement is used in many indicators such as Tirone levels, Gartley patterns, Elliott Wave theory and more. After a significant price movement up or down, the new support and resistance levels are often at or near these lines.

Fibonacci retracement levels are static prices that do not change, unlike moving averages. The static nature of the price levels allows for quick and easy identification. This allows traders and investors to anticipate and react prudently when the price levels are tested. These levels are inflection points where some type of price action is expected, either a rejection or a break.

Trading Fibonacci Retracement Levels

Fibonacci retracement price levels can be used as buy triggers on pullbacks during an uptrend. It is prudent to have a momentum indicator like stochastic or a MACDoscillator to pinpoint the most advantageous entries. In downtrends, the levels can be used to short sell when bounces reject off a Fibonacci retracement level. When a price level overlaps with other indicator price levels like a 200-day moving average, then it becomes a fortified price level, making it an even stronger support or resistance.

The most significant Fibonacci retracement level to watch for is the 0.618. This is the inverse of the golden ratio, 1.618. The 0.618 retracement level tends to be the maximum pullback zone where fear climaxes as the final sellers throw in the towel and bargain hunters rush into the stock to resume the uptrend. On downtrends, the 0.618 price level should be where the final buyers are exhausted as sellers take the opportunity to unload their positions and short-sellers jump off the fence to push down the price and resume the downtrend. Some traders prefer to wait for two to three candlestick closes above or below a Fibonacci retracement level to confirm support or resistance before placing a trade.