Breakouts

In the last section we saw how certain price levels act like glass floors or ceilings. However, glass can be broken, and support and resistance lines do not hold true forever. Let’s look at what you might see when the price does manage to pass through these barriers.

If the market regularly tests a level, at some point the price is likely to break through it – called a breakout. When this happens, the price movement can be very significant – particularly if the support or resistance level was strong to begin with. But why does this happen?

-The more times the price reaches a level and then drops back, the more significant it’s seen to be. Bullish investors might decide only to buy the stock once it’s broken above this level and doesn’t appear to be limited by it anymore. Bearish investors – those that have shorted the stock – could also decide to close their positions (also buying the stock) because they’re worried about taking on too big a loss if the price keeps rising.

This could lead to a far greater number of buyers than sellers at this point, so pushing the price higher. Potentially much higher. This can happen quickly, particularly if there are a lot of orders in the market placed just above the resistance level.

After a breakout through resistance, that resistance level often becomes a support area. Likewise, following a breakout through support, the support level often becomes resistance.

You can also build breakout scalping strategies around strong resistance levels. Thinking outside the box and recognising where loads of stop losses are placed can you give you opportunities to have orders where if the resistance levels are broken you can scalp 5/10 pips where other peoples stop losses have been triggered which pushes the market higher and fills your position.

Fake Breakouts and Traps

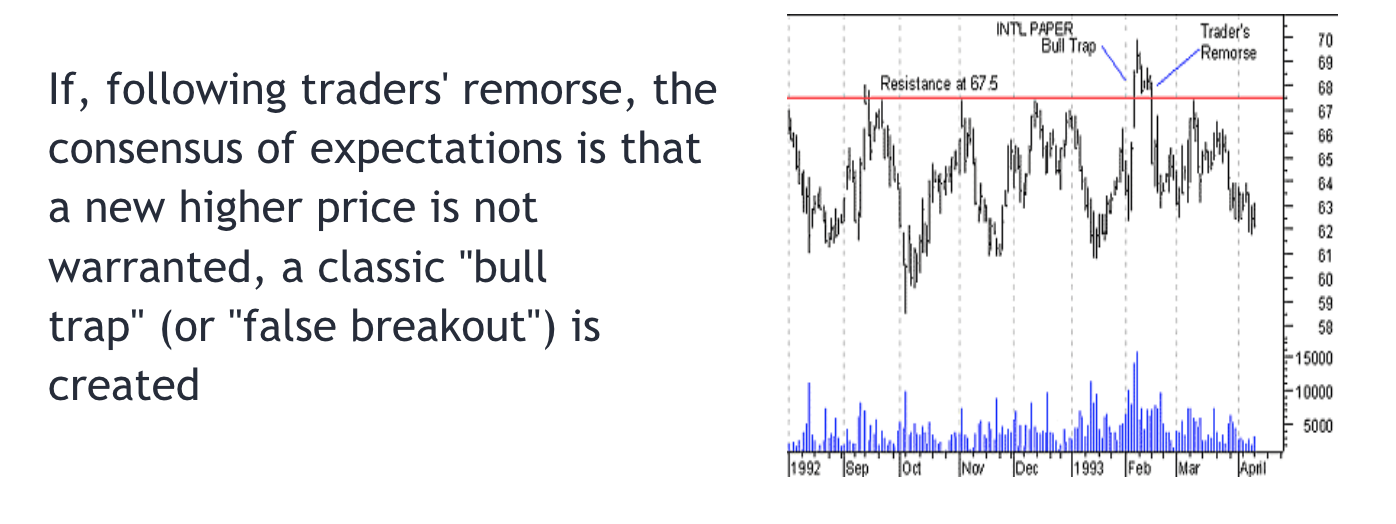

However, as we’ve seen, support and resistance levels are areas not exact numbers. So even if you think the resistance has been broken, other traders might think differently and see a good opportunity to short after a breakout. This is why sometimes its better to just play the breakout with a scalp trade rather than trying to play a longer term position.

Sentiment also plays a part. Many traders might not feel the market is ready to push higher, so will look to go short at as high a level as possible to maximise their profits. This could potentially cause the market to rise above the resistance level briefly before dropping back down again – called a fake breakout. Sometimes this can also be seen as a trap move or a ‘stop hunt’ where the manipulated market triggers everyones stops before going in the other direction. Its very important to look out for these traps and think outside the box whilst trading the markets. Back testing strategies and experience is key into understanding when a trap could occur and how to avoid it. We will cover more on this later on in the course.